The faster payment system is a Bank of Russia service that allows individuals to make instant transfers by mobile phone number to any bank member of the faster payment system, and also to pay for goods and services in retail and the Internet stores using a QR code.

To make a payment on the site using the faster payment system, the customer needs to open the mobile application of his bank (if this bank is a member of the faster payment system) and scan the QR code on the payment page. The customer's bank receives payment information and transfers the funds to the merchant's account. If the courier delivers the ordered goods, then the QR code with the payment information comes to the courier’s mobile device, then it is read through a banking application installed on the customer's smartphone.

Payment using the faster payment system for merchants using IPS Assist is carried out according to the following scenario:

- The customer selects the product or service on the store’s website and proceeds to pay for the order.

- The store redirects the customer to the Assist payment page.

- On the Assist payment page, the customer selects the faster payment system as a payment means.

- Assist registers the payment in the service of the partner bank and receives data for generating a QR code.

- Assist displays a short payment instruction for the customer on the payment page.

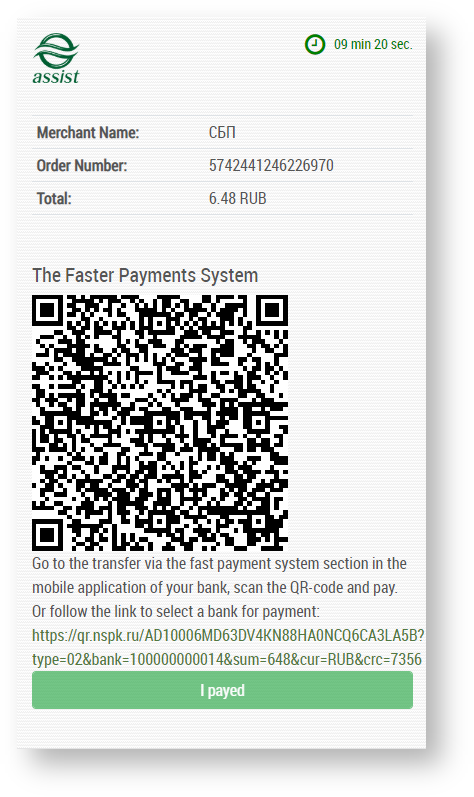

- If the customer clicks the "Back" button, then he can return to the choice of payment means. If the customer clicks the "Get QR-code" button, then on the next page he can scan the QR-code using the bank’s mobile application and confirm the payment.

If the QR code is displayed on the customer's mobile device, where he has the bank application, then the URI link (the contents of the QR code) is also displayed under it. Clicking on this link calls up the bank application through the Intent mechanism. Bank applications must be registered in the system to process such links, and if there are several such applications on the device, a choice will be offered. After selecting an application in it (or immediately in a single bank application installed on a mobile device), the payment process by faster payment system starts (after user authentication) based on data from the QR code. - Assist receives a notification of payment from a partner bank.

- Assist displays the payment result for the customer or redirects the customer to the store website (depending on the merchant settings).

Money is credited to the account of the merchant (store) within a few minutes.

To check the possibility of using the faster payment system, a merchant needs to contact Assist support.

The ability to pay using the faster payment system) is controlled by the FastPayPayment parameter of the authorization request. By default, such payments are allowed.

When receiving of the payment result data, the faster payment system will be indicated as a payment means.

If necessary, the merchant can refund for the payment made using the faster payment system. Refunds in the faster payment system are processed immediately, as well as the payments.

To implement refunds, the merchant should use the standard tools of IPS Assist - cancellations in the Personal Account or via the web service.